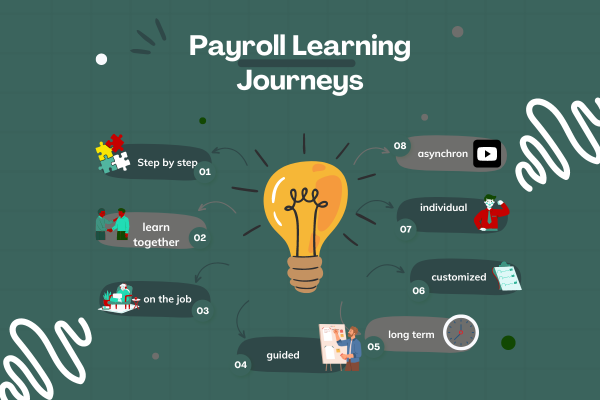

Payroll Learning Journeys

Sustainable payroll training through learning journeys

Seminars are a thing of the past, Learning journeys are the future!

Payroll training at the Payroll Training Academy is designed as a learning journey.

A learning journey is a modern and dynamic approach to learning that differs from traditional seminar formats. Instead of delivering a lot of knowledge in short, intensive seminars and a few days, a learning journey is spread out over a longer period of time and includes various learning methods and resources to promote deep and lasting understanding.

Jana's learning journey – from trainee to payroll pro

What began with uncertainty and question marks became a real success story thanks to training in the Learning Journey concept and continuous payroll coaching with practical learning activities.

Jana embarked on a three-month learning journey as a payroll trainee, and today she is a confident payroll accountant and a successful payroll specialist.

Together, we combined theory, tools and day-to-day business, including plenty of ‘aha’ moments.

👉 Curious? Read more about Jana’s journey in the blog!

Payroll Learning Journeys - How learners benefit

Continuous learning: A learning journey allows participants to continuously learn and grow.

Diverse learning methods: Instead of just listening to lectures, learning journeys use a mix of workshops, online modules, practical exercises, peer learning and individual coaching sessions. This is varied and promotes a more comprehensive understanding. In particular, individual learning platforms play a central role in a modern learning journey. They provide a digital infrastructure that facilitates access to learning materials, interaction and collaboration, and rapid support.

Flexibility and customization: Learning journeys can be tailored to the individual needs and pace of the learner. This is especially helpful for professionals who need to fit learning into their workday.

Practical orientation: By incorporating practical exercises and real-world case studies, learners can directly apply and reinforce their learning. This is particularly valuable in payroll, where the constant alternation between theory and practice is essential to understanding the subject matter.

Long-term support: Learning journeys provide ongoing support and additional resources beyond the course. This can help learners better address real-world challenges and keep their knowledge current.

Example of a Payroll Learning Journey

- Mini-workshops: Introduction to the basics of payroll accounting in several live webinars in short units (‘learning snacks’)

- Asynchronous learning on a learning platform: self-guided in-depth study of the topics with videos, practical exercises, case studies and tasks between the live units

- Peer learning sessions: exchange and discussion with other participants via forums and groups or operational learning time made available.

- Individual coaching: Personal advice and support for specific questions in live video conferences or chats.

- Final exam and final workshop: Summary and evaluation of what has been learned via online exam sheets and planning of next steps for ongoing training.

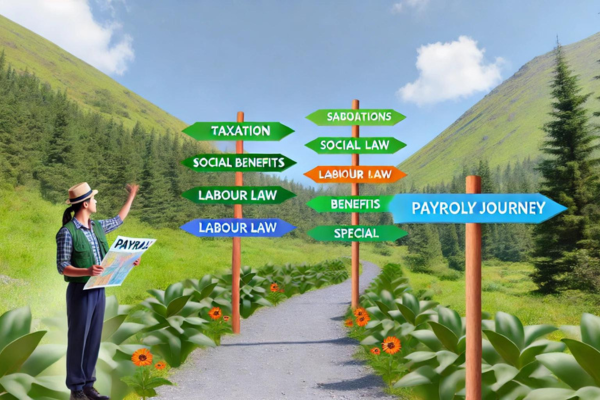

Our Payroll Learning Journey Programs

Payroll accounting training ESSENTIALS – the basic course

Learn the basics of payroll accounting Germany in 6 weeks.

Content:

- Basics labour law (tariff systems, minimum wage, terms in German payroll)

- Basics wage tax law (tax class, tax tariff, cash and non-cash wage, benefits etc.

- Basics socials security law (social security system in Germany

Conditions:

- 4 half-day online-seminars

- 4 hours Payroll-Coaching

(learning support during and after the online seminars) - Access to the online learning platform before, during and after the training courses

- Final audit test

Payroll accounting training MASTERY – the advanced course

Learn the basics of payroll accounting Germany in 3 months.

Content:

- Contents of the basic course

- sick leave, maternity leave, vacation, child care leave, special care leave etc.)

- Special employment relationships (mini-job, short-term employment, working students, pensioners etc.)

- Monthly and year-end closing topics

Conditions:

- 10 half-day online-seminars

- 10 hours Payroll-Coaching

(learning support during and after the online seminars) - Access to the online learning platform before, during and after the training courses

- Final audit test

Payroll accounting training EXCELLENCE – the professional course

Learn the basics of payroll accounting Germany in 6 months.

Content:

- Contents of the basic course

- Contents of the mastery course

- Basics of travel expense law

- Company pension scheme

- Special benefits in kind (company car, job bike, meal allowances, etc.)

- Garnishment of wages (optional)

Conditions:

- 15 half-day online-seminars

- 20 hours Payroll-Coaching

(learning support during and after the online seminars) - Access to the online learning platform before, during and after the training courses

- Final audit test

Interested in our training formats?

No standard. No pattern.

At Payroll Academy, we don’t offer off-the-shelf solutions — only bespoke learning journeys.

Our modular programmes are individually tailored to participants and company practices.

➡️ We only create offers after a personal consultation to discover your training needs!