Jasmin is a second-year Industrial Management apprentice. During her placement in the HR and Payroll department, she caught the attention of the Payroll Management Team. Interested in Payroll? Motivated? Proactive? Jackpot! The management team is delighted, as they urgently need to solve their problem of shortage of skilled labour.

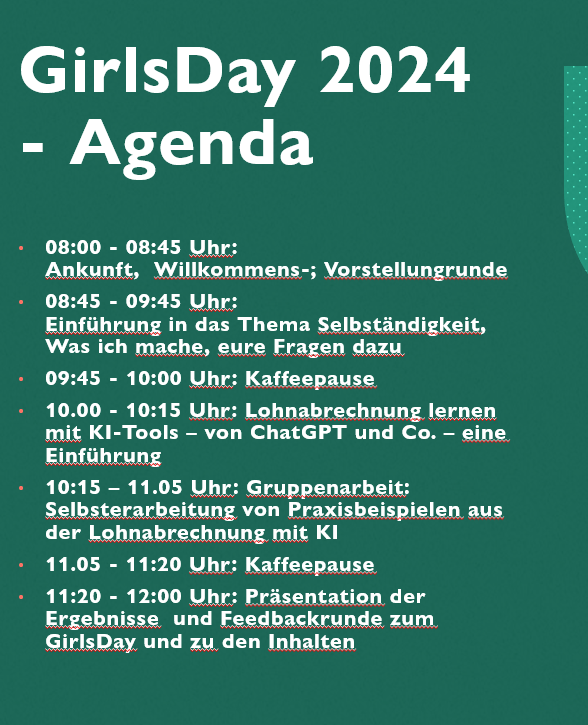

They had already decided to train Jasmin in payroll through a learning journey. The interactive Payroll Academy trainee webinar on payroll and AI served as an introduction. It sparked the interest of other trainees and set the stage for the start of the payroll learning journey, which is playful, practical and digitally supported.

Basic training in the learning journey model

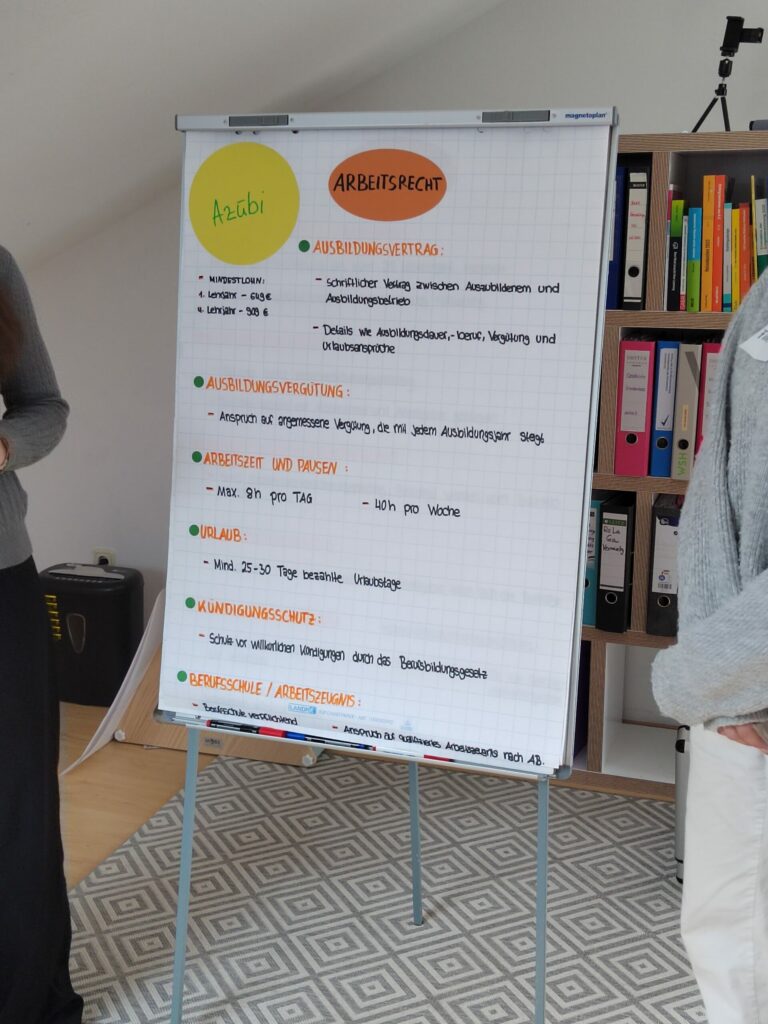

Jasmin worked her way through all the content, from labour law to income tax to social security, with curiosity, discipline, and genuine interest. I was particularly impressed by her independence — she didn’t just want to ‘get through’ it; she wanted to understand how payroll works in everyday life.

Since she had block phases at vocational school during the learning journey, we were able to adapt the flexible concept optimally. Between live training sessions, Jasmin used the learning platform to review and consolidate her learning. She was also given specific tasks to work on, which we reflected on in coaching sessions.

Conclusion: Jasmin has a talent for payroll – and the desire to use it!

Not everyone has a knack for payroll accounting, but Jasmin does. More importantly, she has genuine interest, which cannot be taught.

She is now beginning her practical training in HR and payroll accounting, with a clear understanding of the daily payroll process and a strong technical foundation.

We are already discussing a possible specialisation with the payroll accounting manager after the practical phase. I would be delighted to continue supporting Jasmin.